How To Create A Fintech App In 2024?

The Ultimate Guide

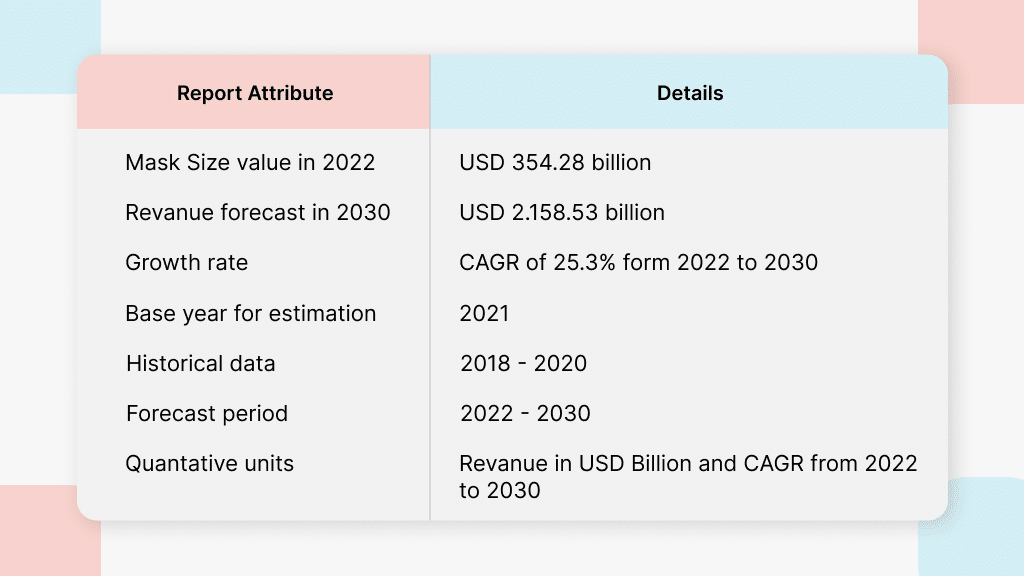

The amount invested in venture capital last year reached a record high of more than $600 billion, according to CB Insights 2021 State of Venture Report. Moreover, investors in venture capital increased the amount of money they invested in each recipient in 2021 compared to 2020. Yet not all industries received the same amount of support. More than any other industry, financial technology businesses have raised more than $130 billion in capital. This implies that understanding how to create a fintech app is a great way to differentiate your company at this time.

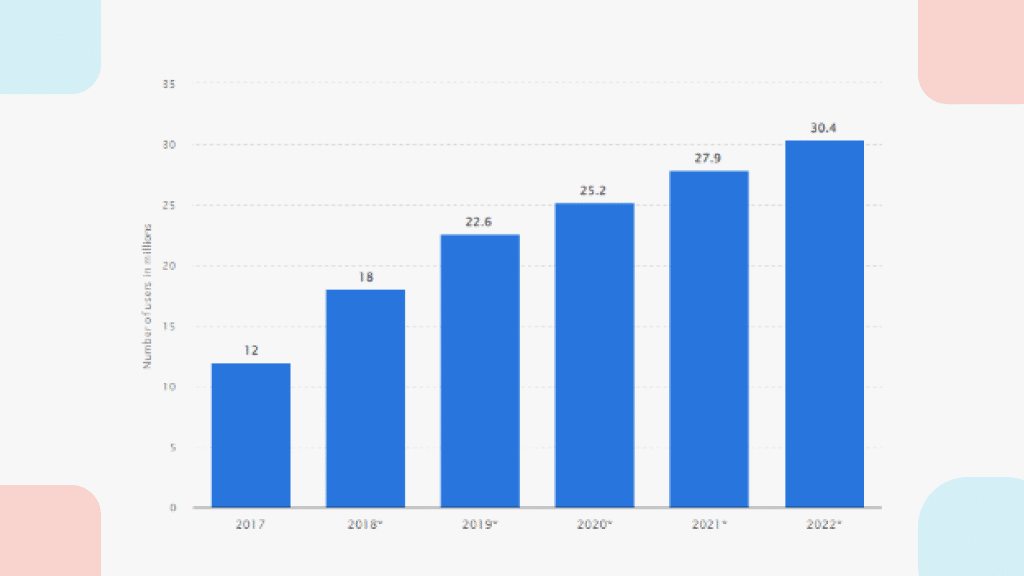

Market Demand for Fintech Apps Globally

Digital Investment, with a total transaction value of US$112.90 billion in 2023, will be the market’s largest segment.

In the Digital Investing market, the average transaction value per user is anticipated to reach US$439.80 in 2023.

In 2024, it’s anticipated that the Digital Investing sector will experience a 22.9% increase in income.

Determine what Type Of Fintech You want to launch

There are many different applications of financial technology. Every facet of the project—from who oversees the development to the functions and user interface that end users engage with—will be influenced by the kind of app you create. It is crucial to comprehend the various fintech categories and the requirements for creating each form of an app.

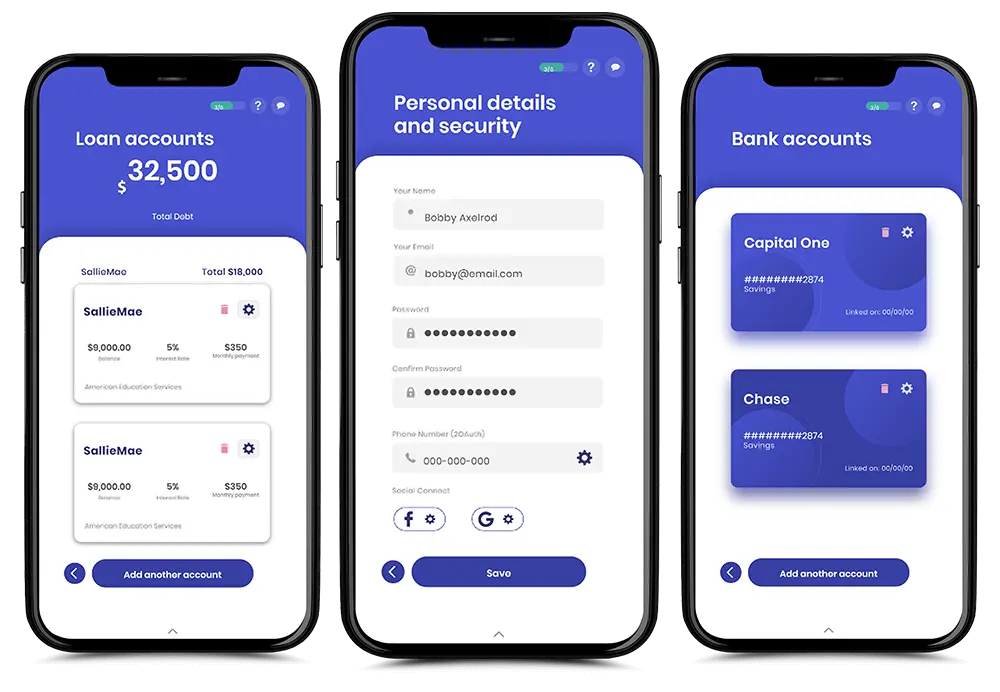

Personal banking and insurance apps are the most costly, difficult, and time-consuming to design. They need two distinct user interfaces with distinct purposes: one for administrators to view customer accounts, and another for users to access and modify their personal accounts.

The cost of developing lending apps is lower than that of other consumer-facing apps. They do, however, necessitate interactive loan applications, which can be challenging to create safely.

Investing applications are primarily made to allow for simple investment tasks, such as purchasing and selling stocks, and to present just information that helps consumers make informed financial decisions. As a result, it is possible to purchase APIs that make the development of the app simpler and less expensive than for other apps.

Benefits Of Fintech App Development Launch

- Market Reach

Since fintech apps are designed to be mobile-first, they can assist firms in reaching a wider audience across a variety of platforms, such as smartphones, tablets, and other mobile devices. For clients who enjoy staying current on news about their favorite businesses, mobile applications are more practical.

In addition, the demand for financial services is rising quickly, making it more important than ever to connect with customers online. This means that in the current digital era, fintech apps are not only a crucial tool for companies wanting to increase income, but they can also help them remain ahead of the competition.

- Search Bar

Fintech app development can eliminate this issue. however, security can occasionally be a problem for any firm. By utilizing the most recent encryption technology, they are designed to provide enhanced security for businesses and their consumers. They are safer, faster, and more convenient than standard online banking services.

- Increase In Mobile Phone Retention Rate

Today, there are 5.13 billion distinct mobile phone users worldwide. That is the same as 66.6% of all people on the earth. According to Ericsson, there will be 5.5 billion smartphones in use worldwide in 2019.

We may fairly assume that a big percentage of these smartphone users have internet access because apps are everything on a smartphone and the majority of them demand having an internet connection.

- Open Banking

People have always had to go to the bank to get financial services going back to the earliest civilizations. Yet now that banks have gone digital, the public can use their services. The motivation for this novel strategy is open banking.

Banks today are aware of the value of connectivity. They stay connected to their clients in the digital age by rewarding their data. They’ve spent millions of dollars creating APIs that let third parties build and provide value-added banking services like loan processing, real-time capital management, treasury management, and mobile credit score monitoring, among many others.

Must-Have Features In An Fintech App

- Security

Any fintech application must abide by security standards that safeguard users’ financial information. A fintech developer uses data obfuscation, encryption, blockchain, biometric and two-factor authentication, and other security methods to accomplish this.

- Payment Gateway Integration

Most fintech applications relate to payments. You can link with services like Stripe, PayPal, and Zelle, or use bank APIs to enable payment capabilities.

- Machine Learning

By this point, AI in financial apps is no longer an optional feature but rather a requirement. Machine learning algorithms collect data from a variety of sources, analyze it, and then offer recommendations.

- Customer Support

Even the best fintech applications occasionally have issues that need to be resolved. So that customers may access assistance when needed, apps must have a customer support structure in place.

- Alerts And Push Notifications

To keep users updated on their finances, several fintech apps use alerts and push notifications. Users may be informed through these notifications of updates to the app’s functionality, new promotions or discounts, or account activity.

- Money Remittance

One of the most crucial components of digital payments is money remittance. It enables users to send money quickly and easily to friends and family members anywhere in the world.

- Multiple Language Options

Fintech apps should provide customers with a choice of languages when it comes to language selections. As a result, users from all around the world can use the app in the language of their choice.

It’s crucial to have multiple language options for two reasons. First off, it makes the software accessible to people anywhere. This increases everyone’s access to and convenience using the app.

- Cost To Create A Fintech App

The price of producing your app will entirely depend on the number of features you imagine, whether you choose to create a mobile site or mobile app development, and whether blockchain development will be used in your app. The longer it takes to develop and the bigger the development estimate, the more integration it will demand.

Topflight Apps has worked on banking apps that have cost up to $160,000 to develop from start to finish (both iOS and Android). The following, alone or in combination, will have the largest negative effect on your fintech app’s development budget if it lacks an AI component:

connecting all API integrations to the back-end business logic of the app

implementing animated, highly interactive dashboards

Before designing your app in full, we always advise beginning with a prototype to test the idea. Once you receive input from actual customers who have used the prototype, many of the features might be changed. So, you have the advantage of maintaining control over the development budget.

Wrapping Up

The development of a fintech app is a challenging process that calls on you to create a wide range of capabilities and functionalities in a highly regulated environment. By providing you with the resources to create the best app possible, relying on fintech APIs enables you to streamline the procedure and deliver a better user experience. For instance, chat APIs enable you to rely on conversational banking strategies to enhance the user experience by providing easily accessible live support when clients need it.